Trustco Bank

- Home

- portfolio

- Web Application

- Trustco Bank

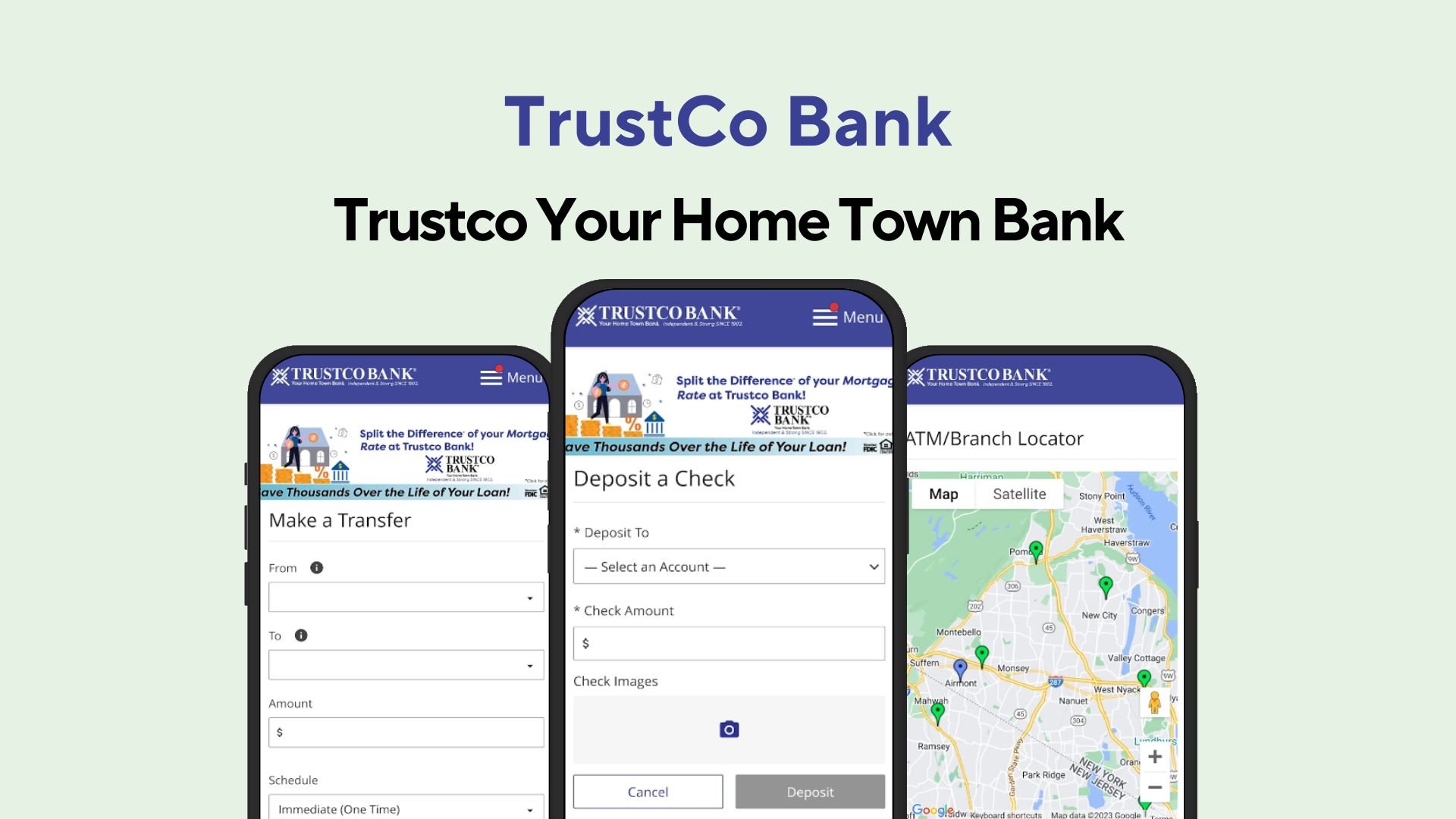

Trustco Bank - Enhanced Fraud Detection with Machine Learning

Project Overview:

In today’s digital banking landscape, fraudsters are constantly devising new tactics to steal money. Trustco Bank, a leading financial institution, recognized the limitations of their existing fraud detection system. It relied heavily on manual review and basic rule-based checks, leading to delays and potential vulnerabilities. Partnering with Mindcrew Technologies, Trustco Bank aimed to develop a cutting-edge solution utilizing the power of machine learning (ML) to automate fraud detection, improve accuracy, and safeguard their customers’ hard-earned money.

Business Needs:

- Minimize Financial Loss: Fraudulent transactions can inflict significant financial damage on banks. Trustco Bank sought to minimize these losses by proactively identifying and preventing them.

- Boost Efficiency: The manual review process for potential fraud was time-consuming and resource-intensive. Automating fraud detection could free up valuable employee time for other crucial tasks.

- Enhance Customer Experience: Detecting and preventing fraudulent activity promptly protects customers’ accounts and builds trust in Trustco Bank’s security measures.

- Regulatory Compliance: Financial institutions like Trustco Bank are obligated to adhere to strict regulations regarding anti-money laundering (AML) and know-your-customer (KYC) practices. A robust fraud detection system plays a vital role in ensuring compliance.

Technical Needs:

- Machine Learning Integration: The core of the solution hinged on integrating sophisticated machine learning models. These models needed the capability to analyze vast amounts of transaction data, identify patterns indicative of fraudulent activity, and generate risk scores in real-time.

- Real-time Processing: Fraudulent transactions can happen instantaneously. The system needed to process and analyze transactions in real-time to prevent them from succeeding.

- Data Security: Since the system handles sensitive customer information, robust data security measures were paramount to ensure information protection.

Solution:

Mindcrew Technologies implemented a comprehensive multi-layered approach to address Trustco Bank’s needs:

- Data Collection and Preprocessing: The first step involved gathering transaction data. This data encompasses details like transaction amount, location, time, beneficiary information, and any other relevant details. Mindcrew’s team then meticulously preprocessed this data to ensure accuracy, consistency, and a format suitable for machine learning models.

- Machine Learning Model Development: The heart of the solution lies in the machine learning models. Supervised machine learning models were trained using historical data that had been labeled as either fraudulent or legitimate. These models learn to analyze real-time transactions and assign a risk score based on how closely they resemble historical fraudulent activity.

- Alerting and Investigation: Transactions exceeding a pre-defined risk threshold triggered alerts for human investigation. This allows Trustco Bank’s security team to delve deeper into suspicious activities, analyze the flagged transactions, and take appropriate actions, such as contacting the customer or blocking the transaction.

- Continuous Learning and Improvement: The beauty of machine learning lies in its ability to learn and adapt. Mindcrew’s solution incorporated a mechanism for continuous learning. The machine learning models were continuously updated with new data, including both legitimate and fraudulent transactions. This ensures the system’s effectiveness remains high even as fraudsters develop new tactics.

Impact:

The implementation of this robust fraud detection system yielded significant benefits for Trustco Bank:

- Reduced Fraud Losses: By proactively identifying and preventing fraudulent transactions, Trustco Bank witnessed a dramatic decrease in financial losses.

- Improved Efficiency: Automation freed up valuable employee time previously spent on manual review. This allows Trustco Bank to focus on other areas like customer service and fraud investigations.

- Enhanced Customer Experience: Faster and more accurate fraud detection protects customer accounts and builds trust in Trustco Bank’s commitment to security.

- Regulatory Compliance: The system plays a vital role in ensuring Trustco Bank’s adherence to AML and KYC regulations.

Client Review:

We are highly satisfied with the results and ongoing support provided by Mindcrew Technologies.- Brandon