Alhilal Bank

- Home

- portfolio

- Mobile Application

- Alhilal Bank

Introduction

The Alhilal Bank app is a comprehensive mobile banking solution designed to provide customers with convenient and secure access to their financial accounts and services. With this app, users can effortlessly manage their finances on the go. The app offers a range of features, including real-time access to account balances and transaction histories. Customers can initiate various types of transfers, including both local and international transactions, as well as pay bills directly from their accounts. The app’s intuitive interface also includes a mobile deposit feature, allowing users to easily deposit checks by capturing photos of them. Additionally, the app offers a locator function to find nearby ATMs and bank branches, making it easy for users to access their funds and services. With a strong emphasis on security, the app provides features such as biometric login, ensuring that customer data and transactions remain protected. Whether it’s managing budgets, tracking spending, or communicating securely with the bank’s support team, the Alhilal Bank app aims to enhance the overall banking experience by providing a comprehensive suite of features at customers’ fingertips.

How it Works

The Alhilal Bank app is designed with user-friendliness and efficiency in mind. Here’s a step-by-step overview of how it works:

User Registration and Biometric Login:

- Customers download the app from the App Store or Google Play.

- They register using their bank account details and set up a secure biometric login (fingerprint or facial recognition) for enhanced security.

Real-Time Account Management:

- Users log in to access their account dashboard, which displays real-time account balances and recent transactions.

- They can view detailed transaction histories and filter transactions by date or category.

Transfers and Payments:

- Customers can initiate local and international transfers with ease, selecting beneficiaries from a pre-saved list or adding new ones.

- The app allows users to pay utility bills, credit card bills, and other payments directly from their accounts.

Mobile Deposit:

- The mobile deposit feature enables users to deposit checks by simply taking photos of the front and back of the check within the app.

ATM and Branch Locator:

- The built-in locator function helps users find nearby ATMs and bank branches, complete with directions and contact details.

Budget Management and Spending Tracking:

- Users can set budget goals, track their spending habits, and receive insights and alerts to help manage their finances effectively.

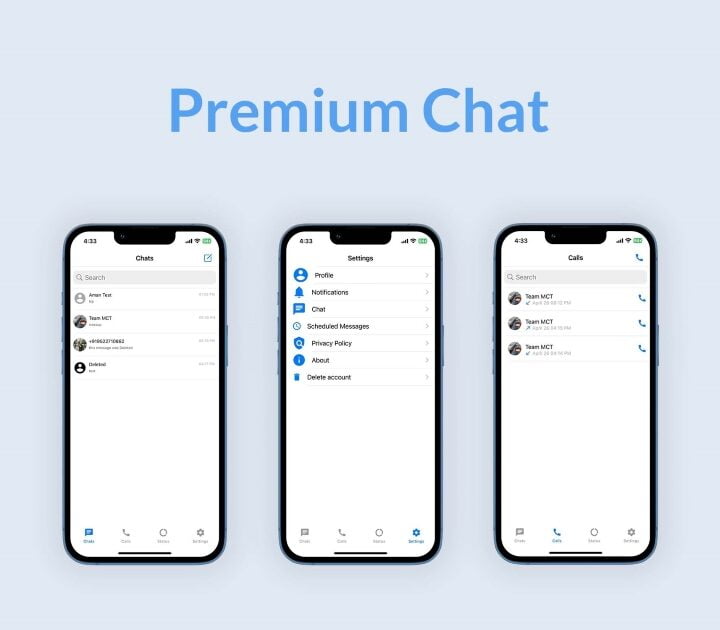

Secure Communication:

- The app includes a secure messaging feature that allows users to communicate directly with the bank’s support team for assistance and inquiries.

.

Process & Results

Process

Conceptualization:

- Identify customer needs and gather requirements through market research and customer feedback.

- Define the core functionalities and features of the app to address those needs.

Design:

- Create user interface (UI) and user experience (UX) designs focused on simplicity and ease of use.

- Design wireframes and prototypes to visualize the app’s flow and functionality.

Development:

- Develop the app using the latest technologies and frameworks to ensure smooth performance across various devices.

- Implement security measures such as biometric authentication, encryption, and secure data storage.

Testing:

- Conduct rigorous testing, including unit tests, integration tests, and user acceptance testing (UAT), to ensure the app is bug-free and functions as intended.

- Perform security audits to safeguard against potential vulnerabilities.

Launch and Marketing:

- Deploy the app on the App Store and Google Play.

- Execute a marketing campaign to promote the app, highlighting its key features and benefits to attract users.

Maintenance and Updates:

- Provide ongoing support and maintenance to address any issues and ensure the app remains up-to-date with the latest security patches and features.

- Gather user feedback to continuously improve the app’s functionality and user experience.

Result

The Alhilal Bank app has transformed the way customers interact with their bank, offering a seamless and secure mobile banking experience. Key results include:

Increased User Engagement:

- High adoption rates with thousands of downloads within the first month of launch.

- Positive user feedback and high ratings on app stores, reflecting customer satisfaction.

Enhanced Security:

- Implementation of biometric login and advanced encryption techniques have significantly reduced security concerns and enhanced user trust.

Improved Financial Management:

- Users have reported better financial management through the app’s budget tracking and spending insights features.

- Easy access to account information and transaction histories has empowered customers to make informed financial decisions.

Operational Efficiency:

- The app has streamlined banking processes, reducing the need for customers to visit physical branches for routine transactions.

- Increased efficiency in handling transfers, payments, and deposits has led to improved customer service and satisfaction.

Customer Loyalty:

- The comprehensive features and user-friendly interface have strengthened customer loyalty and retention, contributing to the bank’s overall growth and success.

The Alhilal Bank app continues to evolve, setting new standards in mobile banking by prioritizing customer needs, security, and convenience.