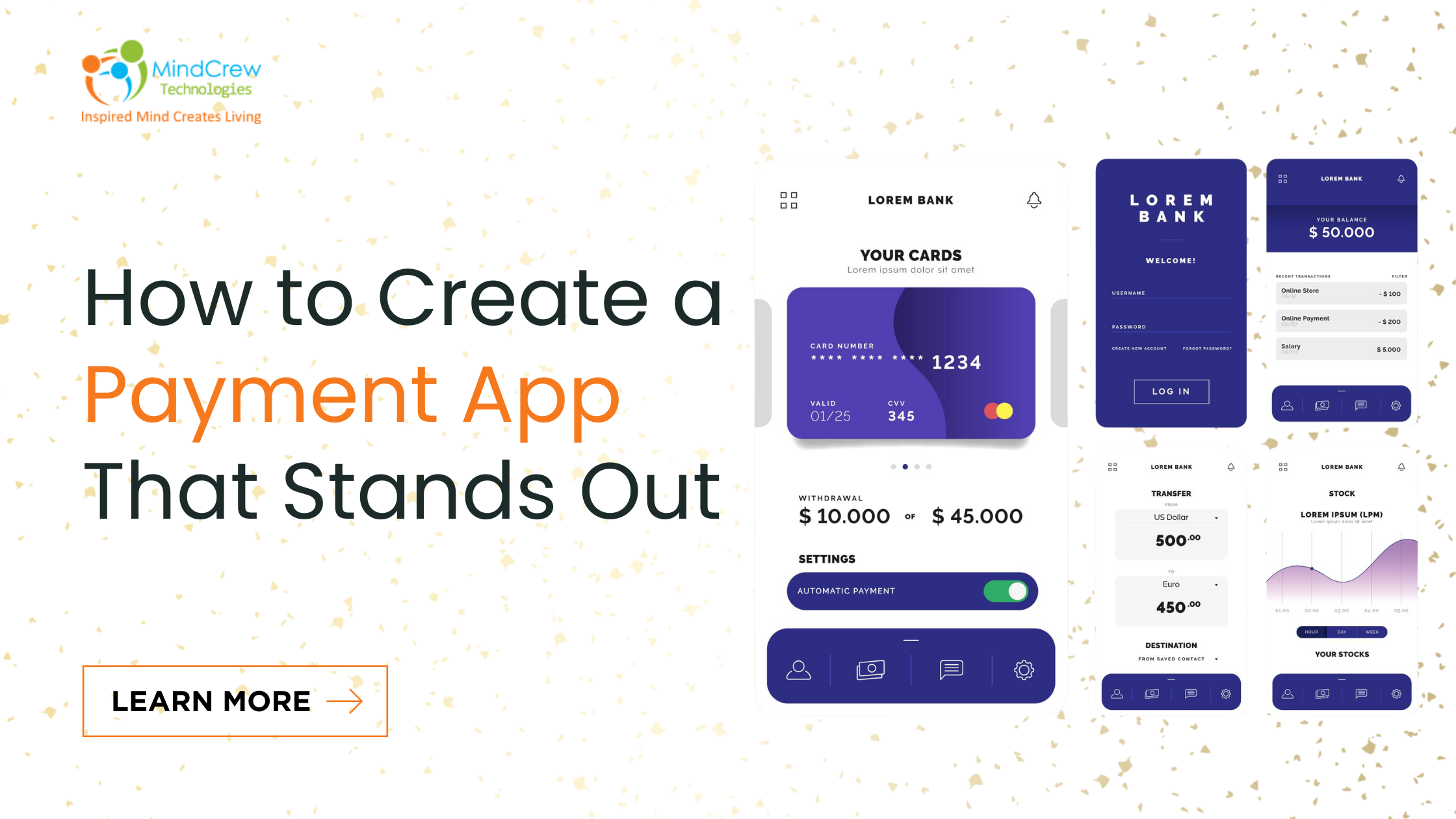

How to Create a Payment App That Stands Out

The days of cash being the dominant form of payment are behind us, making it crucial to understand how to develop a payment app that aligns with the needs of today’s digital transaction landscape. Mobile Payment App Development has now become a key component of modern fintech, allowing for quick, secure, and seamless payments.

From peer-to-peer (P2P) payment apps for easy transfers between individuals to mobile payment apps for retail and e-commerce, digital payment solutions are revolutionizing the way we handle money.

In this comprehensive guide, we’ll explore everything you need to know about payment app development, including essential features, technology stacks, monetization models, challenges, and real-world examples—ensuring your app stands out in an increasingly competitive market. Whether you’re interested in P2P Payment App Development or seeking a Secure Payment App Development solution, this is your ultimate resource for building a successful online payment transfer app.

Key Features of a Successful Payment App

The foundation of any payment app development lies in its features. A successful app must balance security, functionality, and a user-friendly experience to stand out from the competition. Features can be divided into essential and advanced categories.

Essential Features

To create a secure and easy-to-use mobile payment app development, you need the following key features:

- User Authentication: Strong authentication methods like OTPs, biometrics, and multi-factor authentication ensure that only authorized users can access the app.

- Secure Transactions: Encryption and fraud detection mechanisms are essential to protect sensitive financial data during transactions, ensuring secure payment app development.

- Wallet Integration: This allows users to manage and transfer funds easily within the app.

- Transaction History: Detailed records of past transactions provide transparency, helping users track their spending.

- Push Notifications: Real-time updates about payments, balances, and important alerts keep users informed and engaged—vital for P2P payment app development, where trust and timely updates are crucial.

Advanced Features

To further enhance the app’s functionality, security, and overall user experience, modern payment app development services integrate advanced features that streamline transactions, enhance global accessibility, and fortify fraud prevention:

- P2P Payment: Facilitates secure, instant transfers between users for seamless money exchange, essential for P2P payment app development.

- Multi-Currency Support: Enables transactions in various currencies, extending the app’s reach to global markets.

- AI-Powered Fraud Detection: Uses artificial intelligence to detect suspicious activity and prevent fraud before it occurs.

- Rewards and Loyalty Programs: Encourages user engagement by offering cashback, loyalty points, and discounts.

The Payment App Development Process

Creating a successful payment application development requires a well-organized approach. Let’s break down the five key stages of the mobile payment solutions development process:

1. Market Research and Planning

Start by identifying your target audience and understanding their pain points. Whether you’re catering to small businesses, large enterprises, or individual consumers, your app needs to address specific needs effectively.

- Competitor Analysis: Examine established players in the space, like Venmo and PayPal, to understand their offerings and identify gaps or opportunities for improvement.

- Define the Unique Value Proposition: What will set your app apart? It could be advanced features like secure transactions, fraud detection, or other innovative solutions that meet your audience’s needs.

2. Design and Prototyping

This stage is all about shaping your app’s user experience. Start with wireframes to visually map out your app’s interface. Focus on intuitive design principles that make navigation smooth and simple.

- User-Friendly Design: A clean, easy-to-use interface will keep users engaged. For example, an intuitive onboarding process can dramatically improve user retention by ensuring a seamless first experience.

3. Development

Choose a tech stack that suits the needs of your app’s functionality and scale:

- Backend: Technologies like Node.js, Python, or Ruby can power scalable and efficient server-side operations.

- Frontend: Frameworks like React Native, Flutter, or Swift will deliver a smooth, responsive user experience across platforms.

- APIs: Integrating third-party payment gateway APIs is critical for securely handling transactions.

Develop core features such as authentication, wallet integration, and payment processing, ensuring that each part is thoroughly tested during the development phase.

4. Testing and Quality Assurance

Testing is crucial to ensure your app works as expected and is free from bugs. Simulate various real-world use cases to identify potential issues.

- Security Testing: Ensure your app is secure by verifying compliance with standards like PCI DSS and GDPR.

- Bug Fixing: Conduct rigorous bug testing to ensure the app is free from vulnerabilities, and resolve issues promptly before launch.

5. Launch and Maintenance

Once your app has been thoroughly tested, it’s time to launch it on relevant platforms (iOS, Android, or web). Be sure to back your launch with an effective marketing campaign to draw users to your app.

- Ongoing Updates: After launch, continue to monitor user feedback and make improvements based on their needs. Regularly update the app with new features, improvements, and bug fixes to maintain engagement and stay ahead in the competitive market.

Technology and Compliance Considerations

To build a secure, scalable, and user-friendly mobile payment app development, you must address both technological demands and compliance requirements. Meeting these considerations ensures your app operates within legal boundaries while earning user trust. A robust technical foundation and adherence to compliance standards are vital to success in online payment transfer app development.

Technology Stack

Backend Development

The backend serves as the backbone of your app, managing critical functions like transaction processing, data storage, and API interactions. For scalability and reliability, developers typically use technologies such as Node.js, Python, or Ruby, all known for handling high transaction volumes and complex operations.

- Node.js: Excellent for real-time updates, making it ideal for apps requiring instant payment confirmations.

- Python: Versatile and secure, Python is well-suited for building data-driven, scalable applications.

- Ruby: Known for its high availability and flexibility, Ruby minimizes downtime, ensuring smooth operations even during peak times.

By choosing the right backend technology, your app can handle increasing transaction volumes while maintaining security, making it crucial for mobile payment solutions.

Frontend Development

The frontend is the face of your app, shaping how users interact with it. A smooth, intuitive, and responsive frontend ensures a positive user experience. Common frameworks used for frontend development include:

- React Native: Allows cross-platform development, enabling a single app to run seamlessly on both iOS and Android.

- Flutter: Known for its fast rendering and expressive UI, making it ideal for high-performance, visually rich apps.

- Swift: Apple’s programming language, providing a native-like experience for iOS users with smooth performance.

By utilizing these technologies, you can create a user-friendly, fast, and responsive app that works across multiple devices and platforms, delivering a seamless experience for payment app development users.

Compliance

Compliance is critical in the payment app development services industry, ensuring your app operates legally while protecting user data and minimizing risks such as fines or reputational damage. Security measures like encryption, secure communication, and access controls help protect sensitive data, while privacy laws dictate transparency in data collection and handling.

Key compliance measures include:

- Payment Card Industry Data Security Standard (PCI DSS): Protects cardholder data and ensures secure transactions.

- General Data Protection Regulation (GDPR): Regulates data collection, user consent, and privacy for users in the EU.

- California Consumer Privacy Act (CCPA): Provides privacy rights to residents of California, including data access and deletion requests.

- Anti-Money Laundering (AML) Regulations: Prevents illegal activities such as money laundering by requiring certain checks and balances.

- Know Your Customer (KYC) Requirements: Ensures that you verify the identity of users to prevent fraud and money laundering.

Since payment app development regulations vary across regions, it’s essential to comply with local laws wherever your app operates.

Security Measures

Protecting payment apps requires a multi-layered security approach to safeguard user data and transactions. Regular security assessments help identify vulnerabilities before they can be exploited, while tokenization ensures that intercepted payment data remains useless to attackers.

- Real-time Monitoring & Alerts: Automated alerts and constant monitoring enable quick responses to suspicious activities, reducing potential threats before they escalate.

- Role-based Access Controls: Limiting access to sensitive data ensures that only authorized personnel can view or handle user information, further safeguarding privacy and preventing internal misuse.

For P2P payment app development, where secure transactions and user trust are vital, these security measures are even more critical. By proactively addressing security, you not only protect user data but also ensure that your app stays compliant with industry regulations, such as PCI DSS, and stays ahead of evolving threats.

Common Challenges and How to Overcome Them

Developing a payment app development comes with its own set of challenges. Let’s break down some of these challenges and solutions to effectively tackle them:

Ensuring App Security

Challenge: Security is the foundation of any mobile payment app development. Users trust your platform with sensitive personal and financial information, making the app an attractive target for cyberattacks. Breaches, fraud, and data leaks can damage both users and your app’s reputation. This is especially crucial in P2P payment app development, where seamless, secure transactions are a top priority. Without robust security, you risk unauthorized transactions, identity theft, and fraud.

Solution: To protect payment app transactions:

- End-to-End Encryption: Ensures data is securely transmitted during money transfers.

- API Security: Use strong authentication protocols like OAuth and biometric verification to prevent unauthorized access.

- AI-powered Fraud Detection: Detects suspicious activities in real-time, minimizing potential risks before they escalate.

- Multi-Factor Authentication (MFA): Adds an additional layer of security during user verification.

- Tokenization: In P2P payment apps, tokenization reduces exposure to sensitive card details, further enhancing transaction security.

- Regular Security Audits: Ensure compliance with industry regulations (e.g., PCI DSS) and update the app frequently to fix vulnerabilities.

By prioritizing these security measures, you can protect users’ data, minimize fraud, and foster long-term trust in your app.

Building Scalability

Challenge: As your user base expands, your payment app development needs to handle increasing transaction volumes without performance degradation. Poor scalability leads to delays, crashes, and poor user experience, which can severely impact your app’s growth potential. This issue is especially important for P2P payment app development, where instant, reliable, and secure transactions are essential.

Solution: To build a scalable mobile payment app development:

- Cloud-Based Infrastructure: Leverage auto-scaling to handle peak transaction loads without slowing down or crashing the app.

- Load Balancing: Efficiently distributes requests across servers, preventing overloads and ensuring uninterrupted transaction processing.

- Optimized Databases: Implement NoSQL or partitioned SQL databases for faster data retrieval, ensuring real-time transaction processing.

- Microservices Architecture: In P2P payment apps, this approach allows independent scaling of crucial components like authentication, payment gateways, and fraud detection systems.

- Caching and Asynchronous Processing: Speeds up transaction confirmations, especially during high-traffic periods.

- Stress Testing & Monitoring: Regularly test your app’s performance to detect weak points before they impact users.

Proactively addressing scalability ensures your payment app development can handle growth, provide a seamless experience, and remain competitive in the market.

Maintaining User Trust

Challenge: Trust is fundamental to retaining users, especially in a payment application development, where security and reliability are non-negotiable. A lack of transparency or frequent issues can quickly make users lose confidence and switch to competitors. This is especially important in P2P payment app development, where users expect immediate confirmation of their transactions and easy tracking of payment history.

Solution: To maintain user trust:

- Detailed Transaction History: Provide users with transparent, easy-to-understand transaction records, including payments, refunds, and transfers.

- Real-Time Notifications: Keep users informed about successful transactions, failed payments, and any security-related alerts. Immediate updates assure users their financial activities are being monitored.

- Clear Communication: Make sure users know how to resolve any issues, such as failed transactions, and offer easy access to customer support.

By ensuring transparency and providing clear communication, you not only help users track their financial activities but also build trust in your payment app development.

Building Trust and Confidence in P2P Payment Apps

For P2P payment apps, offering instant processing and confirmation of transfers is crucial for establishing trust and confidence. Ensuring that users receive immediate transaction updates creates a seamless experience, which is essential for keeping users engaged.

- Secure Authentication Methods: Implementing robust authentication methods, such as biometric login and multi-factor authentication (MFA), provides an added layer of security. These methods protect users’ accounts and digital wallet balances, reassuring them that their funds and personal data are safe.

- Privacy Policies and Transparency: Transparency around how user data is handled is essential for building user trust. By providing clear, easy-to-understand privacy policies, users can have peace of mind knowing their information is secure and handled in compliance with privacy regulations.

- 24/7 Customer Support: Offering 24/7 customer support, with live chat and AI-driven assistance, helps users resolve issues quickly. Providing prompt and effective assistance ensures a positive experience and further builds user confidence in your platform.

- Proactive Security Updates: Keeping the app secure and functional through regular security updates and performance improvements demonstrates a commitment to providing a reliable and safe service. These efforts help keep users confident in the app’s security and usability.

By prioritizing transparency, security, and responsive support, you can foster long-term trust and loyalty among your users.

Achieving a Smooth UX

Challenge: A smooth and user-friendly interface is essential for retaining users in any mobile payment app development. Poor navigation, confusing design, or slow performance can frustrate users and lead to app abandonment. This is especially critical in P2P payment apps, where smooth transactions and easy access to payment features are crucial for user satisfaction.

Solution: An intuitive, simple design improves usability, helping users navigate the app and complete transactions quickly and easily. Here’s how to enhance user experience:

- Intuitive Design: Ensure the interface is clear, clutter-free, and easy to navigate. Use consistent color schemes, clear labels, and minimalistic layouts.

- Usability Testing: Conduct regular usability testing to identify friction points and gather feedback on the user interface.

- One-Click Payments: Incorporate features like one-click payments and clear call-to-action buttons to streamline the transaction process.

- Fast Processing: Optimize load times and streamline transaction flows to ensure that P2P payment apps are processed instantly.

- Smart Autofill & Personalization: Use autofill for payment details, allow users to create personalized dashboards, and provide easy-to-understand transaction tracking.

- Accessibility Features: Implement voice commands, screen reader compatibility, and other accessibility options to make the app usable for a broader audience.

Regular updates based on user feedback and ongoing performance improvements will ensure that your payment app development remains efficient and user-friendly.

Navigating Regulatory Compliance

Challenge: Compliance with regional and global regulations is a critical aspect of developing a P2P payment app. Failing to meet legal requirements can result in hefty fines, app shutdowns, or loss of user trust. Regulations around financial transactions, data privacy, and fraud prevention can vary, making it essential to stay up-to-date with compliance standards.

Key regulations include:

- Know Your Customer (KYC) and Anti-Money Laundering (AML) rules to prevent fraud.

- General Data Protection Regulation (GDPR) for users in the European Union.

- Local financial regulations and security standards (e.g., PCI DSS).

Solution: To navigate regulatory compliance:

- Engage Legal Experts: Work with legal experts to ensure your app complies with all relevant financial and data privacy regulations.

- Implement KYC and AML Checks: By verifying the identity of users and monitoring transactions for suspicious activity, you can prevent fraud while adhering to global standards.

- End-to-End Encryption: Safeguard sensitive data through encryption and tokenization, reducing the risk of data breaches and protecting user privacy.

- Compliance Audits: Regular compliance audits help identify and address any potential risks or gaps in adherence to regulations.

- Clear Communication of Security Policies: Clearly communicate your app’s privacy and security policies, assuring users that their data is secure.

By prioritizing compliance from the outset, businesses can reduce legal risks, strengthen security, and build trust with users, ensuring the longevity and success of their payment app development.

Monetization Models for Payment Apps

A well-designed payment app not only provides efficient service to its users but also generates consistent revenue for its creators. Here’s an in-depth look at some of the most effective monetization strategies for payment apps, along with considerations for implementation:

1. Transaction Fees

Transaction fees are a key revenue source for payment apps, typically charged as a percentage or flat fee to users, merchants, or both. Apps like PayPal and Venmo charge user fees on services like instant bank transfers, often around 1%. Merchant fees, on platforms like Square and Stripe, are common, with businesses paying a percentage of each sale. Some apps also apply flat fees for smaller transactions.

Considerations:

- Keep transaction fees competitive to attract users while ensuring profitability.

- Offer discounts or fee waivers for high-volume users or merchants to encourage loyalty.

- Clearly communicate fees upfront to avoid user frustration.

2. Subscription Plans

Subscription-based monetization offers users premium features for a monthly or yearly fee. Benefits may include faster transfers, higher transaction limits for individuals and businesses, advanced analytics for merchants, and enhanced security features such as stronger fraud protection.

Considerations:

- Ensure premium features provide clear value over the free version.

- Offer a free trial to entice users to explore premium features.

- Consider tiered subscription plans to cater to different user groups and budgets.

3. In-App Ads

In-app advertising is another way to drive revenue by integrating ads seamlessly into the user experience. For apps with high engagement, such as payment platforms, ads can be in the form of banner ads, interstitial ads, sponsored content, or rewarded ads (where users earn perks, like waived fees or cashback, in exchange for watching ads).

Considerations:

- Ensure that ads are relevant to the user base to maximize engagement.

- Avoid overloading the app with ads, as this can negatively affect the user experience.

- Use targeted advertising to appeal to specific user segments based on behavior or preferences.

4. Freemium Models

A freemium model provides basic app features for free, with the option for users to pay for premium upgrades. Free features might include basic payment and transfer capabilities, limited transaction limits, and essential fraud protection, while premium users can unlock features like multi-currency transactions, recurring payments, detailed financial insights, and customizable dashboards for merchants.

Considerations:

- Strike a balance between free and premium offerings to avoid alienating free users while motivating upgrades.

- Use persuasive messaging to showcase the value of premium features.

- Periodically introduce limited-time offers to encourage users to explore premium options.

Real-World Examples of Payment App Monetization

To better understand what makes a payment app successful, let’s take a closer look at three leading platforms: Venmo, PayPal, and Square. Each of these platforms has carved out a unique niche by addressing specific user needs and creating exceptional user experiences.

1. Venmo

Venmo has become synonymous with peer-to-peer payments, particularly among younger users, thanks to its social features and easy-to-use interface.

Key Strengths:

- Venmo turns payments into a social experience, allowing users to add emojis, notes, and comments to transactions, making money transfers more engaging and fun.

- It offers an easy way to split bills, pay friends, or send money for everyday activities (e.g., rent, dining out).

- Venmo integrates seamlessly with bank accounts and debit cards, offering flexibility in how users send and receive money.

Why It Works: Venmo’s focus on social payments boosts user engagement and differentiates it from other payment platforms. Its simple, intuitive design ensures quick and seamless transactions, while its emphasis on millennials and Gen Z keeps it modern and aligned with the digital habits of younger generations.

2. PayPal

PayPal is one of the earliest pioneers in payment app development, evolving from an online payment processor to a globally recognized brand with millions of users, both individuals and businesses.

Key Strengths:

- PayPal allows users to send and receive payments securely across the globe.

- It offers a wide variety of payment methods (credit/debit cards, bank transfers, etc.) and is widely accepted by online merchants.

- Businesses can benefit from PayPal’s merchant services, including invoicing, subscriptions, and customer support tools.

Why It Works: PayPal’s longstanding reputation as a secure, reliable payment platform makes it a trusted option for both individual users and businesses. Its global reach and extensive merchant integrations give it a significant edge in the market.

3. Square

Square is a payment platform designed with business owners in mind. It allows small to medium-sized businesses to accept payments, manage inventory, and even access financing options.

Key Strengths:

- Square offers a variety of tools for businesses, including point-of-sale systems, mobile payment solutions, and access to business loans.

- The Square Reader enables businesses to accept credit and debit card payments via their smartphones or tablets.

- Square also offers e-commerce solutions and integrates with third-party apps for seamless operations.

Why It Works: Square’s focus on small businesses has helped it gain widespread adoption among entrepreneurs. Its all-in-one solution for payment processing, business management, and financing appeals to businesses of all sizes.

Our Expertise in Payment App Development

At Mindcrew, we specialize in creating custom financial solutions, including P2P payment app development and secure transaction systems. One of our standout projects was the development of a stock trading platform, where we showcased our ability to integrate advanced payment functionalities seamlessly into complex systems.

For this project, we designed and developed a comprehensive stock trading platform that incorporated robust features such as real-time analytics, wallet integration, and secure payment processing. By focusing on a user-centric design and ensuring strict security compliance, we delivered a solution that empowered users to trade stocks confidently and efficiently.

Key Highlights of Our Expertise:

- Wallet Integration

The platform included a built-in digital wallet, allowing users to securely deposit, withdraw, and manage funds without relying on third-party services. With real-time balance updates and automated transaction tracking, traders experienced a smooth and transparent payment process, eliminating the need for additional payment intermediaries. - Real-Time Data and Analytics

We integrated real-time market insights into the platform, empowering users to make informed trading decisions. Advanced charting tools and predictive analytics enabled traders to track price movements, spot trends, and receive automated alerts. This feature provided users with a competitive edge by allowing them to act quickly on important market shifts. - Advanced Security Features

Security is paramount in financial applications. To safeguard user funds and sensitive data, we implemented a range of advanced security features, including multi-factor authentication, end-to-end encryption, and fraud detection algorithms. These measures ensured that only authorized users had access to the platform, preventing fraud and maintaining the highest levels of cybersecurity. - Scalability

We built the platform with scalability in mind. Using a cloud-based infrastructure and load balancing, we ensured that the system could handle high transaction volumes efficiently. During peak trading hours, the platform performed seamlessly, and as user demand grew, the system automatically scaled to meet new demands without disruption.

Why Choose Mindcrew for Your Payment App Development

This project highlights our deep expertise in developing high-performing, secure, and scalable financial platforms. Whether you’re working on P2P payment app development, multi-currency transactions, or an online payment transfer app, Mindcrew combines technical innovation with user-centric design to deliver solutions that excel in the competitive FinTech landscape.

From ensuring compliance with industry regulations to implementing the latest security protocols and ensuring scalability, we make sure your payment app is secure, fraud-proof, and capable of handling growth.

Ready to get started? Let’s turn your payment app vision into a seamless, secure, and innovative solution that sets you apart in the market.